Give us a - tax - break, say rescuers

Stewart Hulse has tasted stardom. He used to kick a ball around for Bury FC in the days when players ‘got paid 8s and 6d’ and was also handy with a cricket bat in the summer months. He was even made an MBE six years ago.

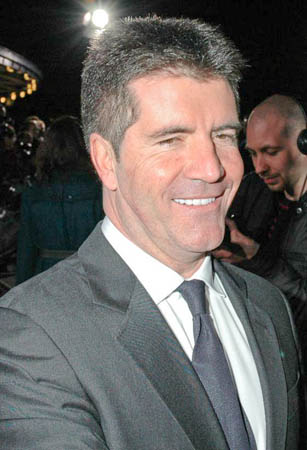

Simon Cowell is no stranger to the limelight either. Gaining his notoriety as a Mr Nasty on television talent shows, he redeemed himself in many people’s eyes by putting together the charity version of REM’s Everybody Hurts to raise millions for the stricken people of Haiti following the devastating earthquake that killed thousands of residents of the Caribbean country recently.

But, whereas Cowell was able to persuade the Prime Minister to waive value added tax on the record’s proceeds, Hulse has had less success in getting tax relief for a less glamorous charity: the men and women who head for the mountains of England and Wales in snow, gales, darkness, freezing cold and blistering heat to help walkers and climbers who have come to grief.

Because Stewart Hulse is better known these days for his mountain rescue efforts. He was in the Langdale and Ambleside team for 42 years – hence the MBE – and nowadays sits on the fundraising committee of Mountain Rescue England & Wales, the national body for rescue teams south of the border.

It took hardly any effort at all for Simon Cowell to get a tax break for the worthwhile effort to help the poor people of Haiti. Almost as soon as the project was suggested, Gordon Brown said: “I have already talked to Simon Cowell and I said there would be an exemption from VAT for a charity single.”

Hulse has had less success and, talking to him, one gets a sense of immense frustration from more than five years getting what he sees as a fairly moderate concession: £200,000 a year – the amount the 56 volunteer mountain rescue teams of England and Wales pay in VAT, fuel duty and other tax.

Speaking to grough, he reels off the names of Treasury politicians he has tried to persuade: Paul Boateng, John Healey, Angela Eagle, Stephen Timms, Sarah McCarthy-Fry and now Ian Pearson. All have come up with the same excuse: European rules won’t let Her Majesty’s Government give tax relief to British Mountain Rescuers. Each time ministers were approached, or indeed public pressure was applied via a Downing Street e-petition, the answer was the same.

Hulse said: “I and my colleagues have been going to meetings with Treasury ministers over the last four years. We have been asking for VAT relief on items we pay VAT on.”

He pointed out anomalies in the tax system: “A mountain-climbing helmet is not exempt from VAT, but a cycling helmet is. Personal protective equipment is not exempt and climbing gear is not exempt. But our rescuers rely on these to carry out their work.”

Each time Hulse and his colleagues thought they were getting somewhere, the minister was moved to a different role and it was back to square one.

Mountain rescue vehicles and equipment suffered damage during rescues in the Cumbria floods and snow and ice

He is very clear that he is not out to denigrate the efforts of the Haiti fundraising record, which he said is laudable and necessary. “With this Haiti job, because Simon Cowell is high profile, this is great,” Hulse said. “We all have to applaud what has gone on with the people doing their bit for Haiti. Anything goes.”

Hulse and his colleagues in mountain rescue are just asking for little understanding and fairness to a service that is estimated to save the Government up to £6m a year.

There is a sense that Whitehall ministers and mandarins have no real comprehension of what the teams are about. A lengthy, 2,500-word report compiled by Hulse and fellow fundraising committee members Andy Simpson and Richard Longman oozes frustration.

“Treasury minister Ian Pearson ‘stated that if HMG were to give a VAT rebate to mountain rescue teams, then other charities such as, hospices, drug treatment centres, (excellent charities, who do dedicated work) would have to be considered as well’,” the report said. “However, we could not see the connection between MR, a front-line emergency service, and non-emergency charities.

“This reminded us of when we had a meeting with Angela Eagle MP. She compared and aligned mountain rescue to the Cats Defence League, again a worthy cause, but not exactly a like-for-like life saving service in which human life can be at stake.

“Sadly every treasury minister we have corresponded or had meetings with does not appear to be conversant with the workings of mountain rescue, which has led to them failing to comprehend our problems. HMG seem to disregard factual problems and shroud everything in irrelevant generalisations.

Despite the name, much of mountain rescue teams' work takes place away from the hills

“If we are to be compared with other organisations then it’s up to HMG to treat like with like.

“If that were to be the case there is only one direction HMG should follow and that is to align mountain rescue with the statutory emergency services; in our opinion no other comparison can be accepted.

“When national and regional emergencies devastate certain areas of the UK, there is no emergency service which is more adaptable than mountain rescue teams.”

The report points out that mountain rescue is the only emergency service that operates 24 hours a day, every day, in all weather.

Ministerial replies suggest poor briefing. Ian Pearson told Mountain Rescue England &Wales in October last year that if concessions on tax were made to mountain rescuers, they would have to be applied to cave rescue too. Fine by us, said Hulse – cave rescue teams are members of MRE&W!

And here’s a curious thing: when Hulse met László Kovács the European Commissioner for Taxation and Customs Union, he said there was absolutely nothing to stop HMG giving mountain rescuers a rebate.

He told them: “I should point out in the commission’s view there are other, more effective, tools than VAT exemptions available to member states to organisations such as mountain rescue teams.

“This could for example take the form of direct subsidies compensating partially or totally the cost of VAT on their purchases. Such tools are entirely a matter for individual member states and do not depend upon European Union legislation.”

Which rather suggests the Government, or its civil servants, are obfuscating when they could easily be acting.

The response from a Treasury spokesperson to grough’s request for a view is typical of the deliberate, or otherwise, missing of the point. “Government recognises and values the commitment and essential work that organisations such as mountain rescue charities provide,” said the spokesperson. “There is no further scope for relief through the VAT system. However Government does provide support to these charities, who can benefit from purchasing zero-rated specialist equipment and VAT free medicine and medical equipment.”

It’s the kind of answer that gets mountain rescuers hot under their Gore-tex collars.

Tim Farron MP

Tim Farron, Liberal Democrat MP for Westmorland and Lonsdale, has championed the rescuers’ cause, to the extent that Vince Cable, the party’s treasury spokesman, has promised it will be a manifesto commitment to compensate mountain rescue teams for the tax they pay.

Hulse was due to meet minister Ian Pearson on 4 February, but the appointment was cancelled at short notice. However, Pearson does still seem keen to meet the rescuers, so there could be some hope.

Hulse’s letters to Conservative shadow chancellor George Osborne have gone unanswered.

In Government budget terms, £200,000 seems like a drop in the ocean and would seem like money well spent. Even Private Eye, the satirical magazine, ran an article recently asking why the Government can’t treat the rescue teams like Cowell’s star-studded singers.

The Scottish Government coughs up £300,000 a year to support teams the other side of Hadrian’s Wall. It’s not too much to ask Whitehall to do the same, is it?